Resources

We offer a number of ways to help you learn, track, build, and accelerate wealth, to help you live the life of your wildest dreams and do whatever you like.

Free tips!

Join the '14 Days of Financial Wellness' Challenge

Let’s get those finances in shape.

14 carefully created, actionable, wealth-building, tiny tips: designed to complete in 4 minutes or less each day, with lasting effects on your wealth journey. Each day, 1 tiny tip will be delivered to your inbox.

Get Started with Stock Investing 101 'Everything' Digital BootCamp

90% off for limited time and while discounted seats available

To accelerate wealth-building, a strong investment portfolio is essential. Stock investing does not have to be confusing or complicated. You just need the right mix of steps and practical knowledge that you can easily apply to get started with confidence and have a strong foundation. Enjoy simple terms, covering end-to-end what you need to know to get started in making informed trades, including actual stocks.

What’s covered:

Section 1: Introduction to Stock Investing

- Session 1.1: Addressing Concerns and Myths

- Session 1.2: Understanding the Basics

- Session 1.3: Different Types of Investments

- Session 1.4: Types of Investment Accounts

Section 2: Essential Concepts for Beginners

- Session 2.1: Compound Interest and Its Importance

- Session 2.2: Different Types of Stocks

- Session 2.3: Taxes and Paying Uncle Sam

Section 3: Navigating the Investment Landscape

- Session 3.1: Different Stock Markets

- Session 3.2: Indexes and Their Significance

- Session 3.3: Understanding ETFs and Index Funds

- Session 3.4: [LIST]: of Beginner-Friendly ETFs / Index Funds

Section 4: In-Depth Exploration of Investment Accounts

- Session 4.1: Roth IRAs and HSAs: A Deep Dive

- Session 4.2: Best Practices for Selecting a Brokerage

- Session 4.3: [LIST]: of Popular Brokerage Companies

Section 5: Developing Great Investing Habits

- Session 5.1: Cultivating Consistency and Automation

- Session 5.2: Real-World Examples with Real Numbers

- Session 5.3: Helpful Tips

Section 6: Crafting a Long-Term Investment Strategy

- Session 6.1: Setting Financial Goals

- Session 6.2: Diversification and Portfolio Management

- Session 6.3: Monitoring and Adjusting Your Portfolio

Section 7: Dividends and REITs - Creating Passive Income

- Session 7.1: What Are Dividends?

- Session 7.2: Dividend Growth vs. High-Yield Stocks

- Session 7.3: Reinvesting Dividends: Growing Your Wealth Effectively

- Session 7.4: What are REITs (Real Estate Investment Trusts)?

- Session 7.5: [LIST]: of Beginner-Friendly Dividend Stocks & REITs

Section 8: The Economy and Influences on the Market

- Session 8.1: Bull vs. Bear Markets

- Session 8.2: The Impact of Inflation and Interest Rates

- Session 8.3: Economic Indicators and Their Significance

- Session 8.4: Market Sentiment and Its Role

Section 9: Step-by-Step Guide to Your First Trades

- Session 9.1: Choosing Your Account / Brokerage

- Session 9.2: Choosing Your First Investment

- Session 9.3: Placing Your First Trade

- Session 9.4: [LIST]: Popular Investments / Portfolios for Beginners

Section 10: Questions, Resources, Conclusion and Next Steps

- Session 10.1: Recap

- Session 10.2: Questions

- Session 10.3: Resources

- Session 10.4: Final Thoughts and What’s Next

You also get:

Checklist: Step-by-step walkthrough to open a brokerage account and make your first informed trades

List / Worksheet: List and details for some of the best stocks for beginners and dividend stocks

List / Worksheet: Beginner's 'Just Do It' Bundle of Beginner-Friendly Stocks

On-demand access to watch and review at your own pace

Mobile and Online access

One guided Coaching Session: schedule anytime after you register, up to 6 months out

Get the practical knowledge you can apply today to make your first informed trades.

90% off for limited time and while discounted seats available

—

Access Provided on February 14, 2024 | Webinar Bootcamp

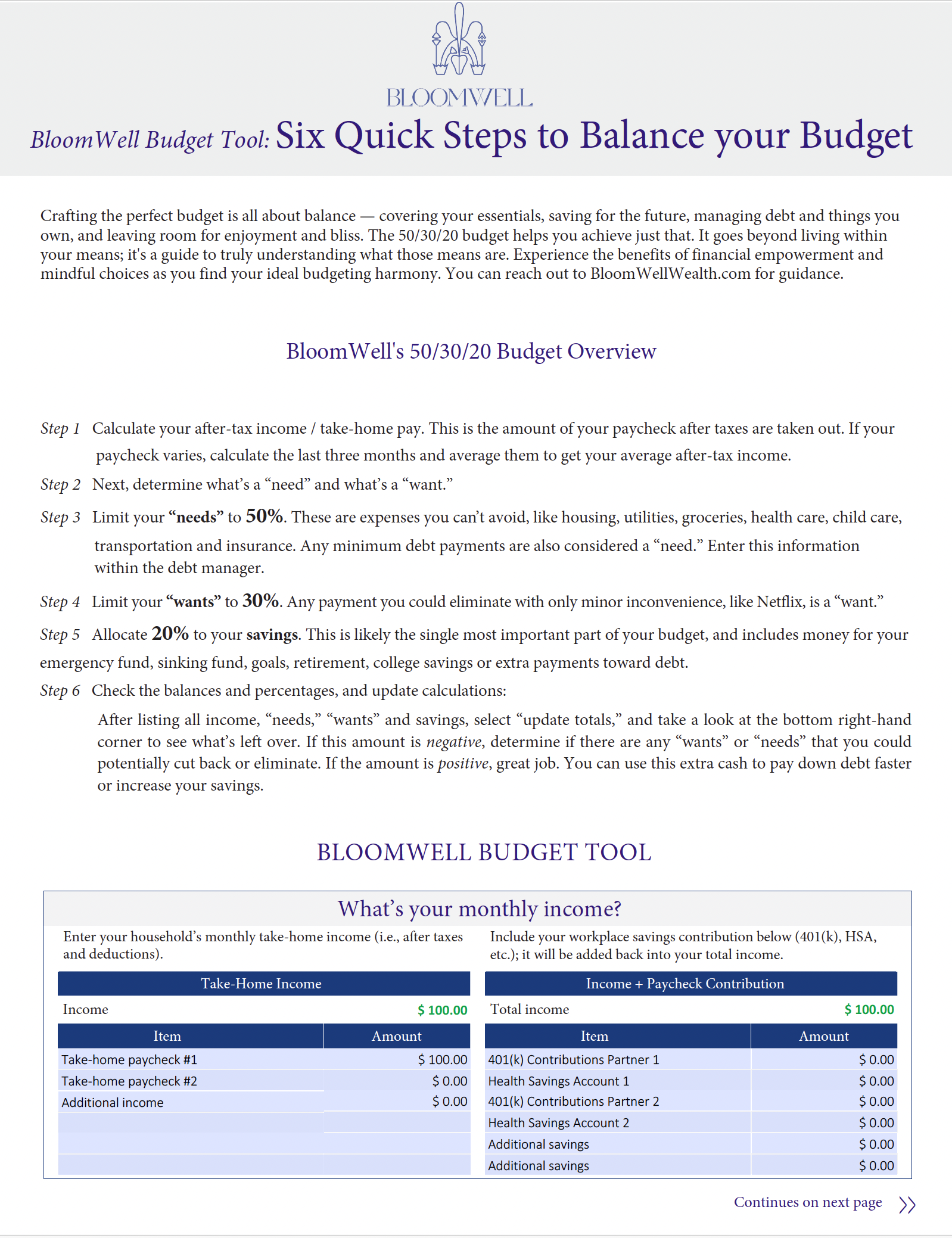

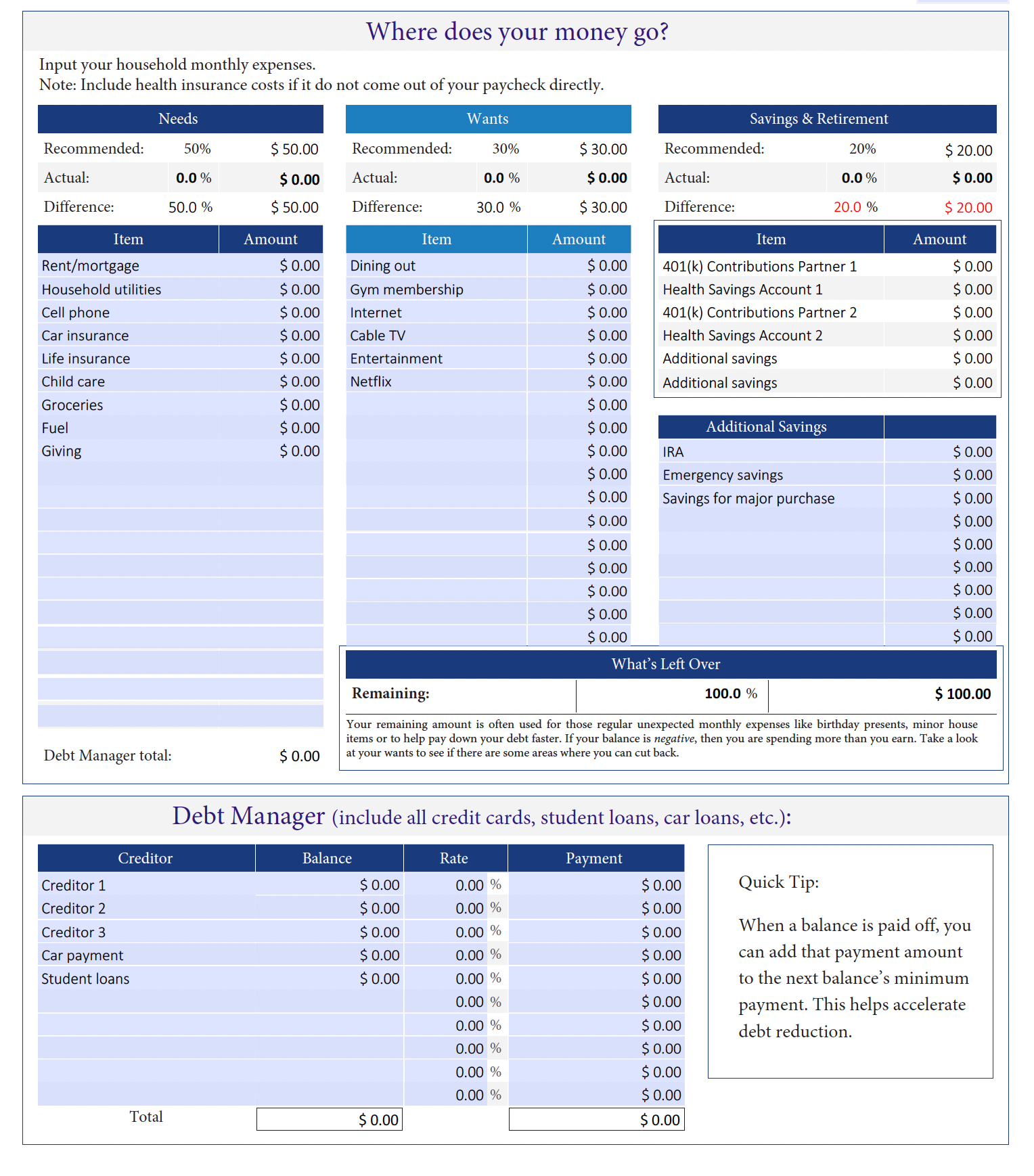

BloomWell Budget Tool: 50-30-20 Budget

Interactive! Calculates automatically

How much should you save? How much should you spend? Are you on track?

Put the calculator and concern away, and take the guesswork out of where your money goes every month.

Use our interactive 50-30-20 Budget tool to automatically see and understand where every dollar is going, and what percentage of your income is going to wants, needs, and savings — and how much you have left over. This tool includes a Debt Manager to also calculate and give you a holistic picture of your debt.

The budget tool that keeps on giving — use it every month! use it at home or on the go.

Instant download | Interactive PDF

$45 FREE for limited time only

eBook: Wealth Strategies Action Guide

Jumpstart your wealth building!

How do the wealthy accelerate their wealth? — with shortcuts and strategies.

Wealth smarter, not harder. Kick off your wealth journey with 5 proven, simple, actionable strategies you can start using today to build wealth — worth over $190,000. Enjoy part of BloomWell’s building blocks of wealth.

Includes some of our most popular and most effective money strategies.

Instant download | eBook

$45 $10 for limited time only

We specialize in simple, supportive, actionable money strategies, planning, coaching, guidance, education and resources across: